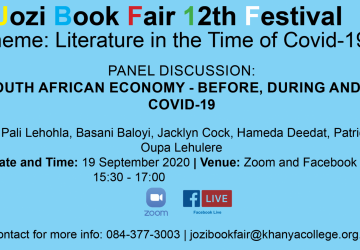

RADIO 786 interview with Oupa Lehulere

Tashreeq (Radio Host):

President Cyril Ramaphosa hopes to raise over a trillion rand new in investment over the next five years to boost the economy. The ambitious target comes as the country prepares to host an investment conference later this year which the…

Oupa:

Thanks very much Tashreeq and thanks to your listeners as well.

Tashreeq:

Over a trillion rand, it’s an ambitious target. What would this mean for our economy? Is it actual jobs or are we just trying to raise capital? What is your sense about this investment drive?

Oupa:

Well, I think firstly it is important to note that actualy foreign direct investment in the South African economy has been on a long-term decline over many years. Secondly, South African corporations have been exporting capital on a massive scale over the same period. The third point I would like to preface this discussion with is that the same corporations within South Africa have been hoarding literally billions dollars of cash. In fact it is quiet interesting that the target that the President has put for this road show is about $100 billion. As at around 2016 South African corporations had almost $50 billion sitting in cash in South African banks, and these are numbers reported by South African Reserve Bank. So it is important to preface [this discussion on the investment] road show with these three points.

The point of course that you asking is whether this will mean jobs. Again we must not assume that these kind of numbers neccesarly translate into jobs. Firslty I think we had over the last few years a very well entrenched phenomen of what people ‘call jobsless growth’, in the other words where investments of this kinds are relatively technology intensive. They create very few jobs relative to the scale of the investments, and also they sometimes do not create the kind of investments that are of a long-term nature and that uplift the people’s standards of living. For instance we have a situations were a company like Mercedes Benz may invest in a plant but it’s an assembly plant for the export of its high value vehicles from the country, which means that actually it is using the country as an outpost for a range of different reason – labour cost, regulatory regimes, profits exports and all these kinds of things. …. So I am not very optimistic that with this kind of road show we looking at a major change. [Further], $100billion is too small and actually can be sourced within the country quite comfortably.

Tashreeq:

I want to take a look at who these investors would be. There is almost the setting of a tone by those that serve on the team of the President. It is these individual who will…get the opportunity to talk to those investors. We looking here at Trevor Manuel, of course he is the former Finance Minister, he now works for the Rothschilds. The concern by some South Africans is that we once again trading the liberal economic framework, much of which we saw under former President Thabo Mbeki. Are we seeing exactly that and does it matter who the investors are?

Oupa:

Well it will matter a lot who these investors are because [of] the terms on which this investment will be sourced. Already at the moment South Africa has a massive empolyment problem. If you have a situation where we do not insist on certain favourable terms [for] employment creation, for the quality of the employment, for the level of income of South African population, we basically perpetuate a situation where we have investors here that insist on the deregulation of labour market; they insist in the privatisation on various state assets; they insist on a [worse] profit repatriation regime than we [now currently] have; which means at the end actually the originally expressed intentions of bringing foreign invest will not be realised. So there is a problem that a neo-liberal economic framework, if it used as the framework to source this kind of investment basically will continue the upward trend in unemployment, the downward trend in growth posibilities, [and will produced] a…very skewed growth process were the GDP numbers are going up, but the standards of living of the majority are actually declining.

It is important to note that the President is appointing this team to go overseas to make agreements on terms, but he is actually – from the point of view of the people of South Africa – [putting] the cart before the horse. What we should have had [first] was [an] internal ndaba on [the] development of the economy where the terms of how growth should be inclusive, …of how the growth should actually benefit local small companies – in other words the framework of such a road show would have been agreed by to labour, community groups and NGOs working in this area and by small businesses. [The envoys] would have been going overseas as kind of representatives of a much broader concensus. At the moment what we [have] … – as you rightly said when you looked at where these people are based – [are representatives] … of large of South African corporates who themselves are involved in major capital export. And so what we see coming with this kind of thing is not a situation where a national concensus of all affected and interested parties its constructed, but actualy an imposition of terms that will be favourable to much of the larger corporate groups in society.

Tashreeq:

Talk to me quickly about the fact that the investment team that has been put together – of course they serve at the behest of the President – their first port of call it seems is indeed London. Does it matter exactly where they head to because as I understand it, and I have heard the president himself talk about South Africa’s clear position that it looks East, it also comes in the midst of a pending Brics summit – and South Africa [is] party to the group of Brics countries. It doesn’t seem to me that South Africa under its current President is even looking East or towards its fellow Brics countries or that region to stimulate economic growth. It is still seems we are heading to London.

Oupa:

That is quiet interesting and I would even take a step [before this] and ask why is it that South Africa does not speak to Africa first. Because if South Africa’s express intention – and the president mentions this, [is that it] wants economic intergration with Africa; it wants a mutually beneficial expansion of African markets. [Given] that the numbers that we looking at are so miniscule – $100 billion – [for] the Brics Bank and the other actors this is relatively small change. The point I want to make is that the importance of this trip is not the amount of investment because it can be found without even crossing the border, you will find this kind of investment sitting in the banks as a cash pile.

The issue here is that this is a signal to western markets, basically London, USA, and European markets that, as the President puts it – ‘we are open for business’, that we are prepared to agree to the terms that you (Western markets) put. If it was an issue of a serious major investment in the economy the Brics countries are very well capable of this kind of [investment]. It is ironic in fact a big part of Europe – 16 countries of the so-called 16+1 group – are partnering with China for a massive infrustructure programme in Central and Eastern Europe. Now if you look at European countries going East and South Africa goes to London, [then] we are not looking [at] an economic programme here – we are given a veneer of an economic programme: [what] we are looking at is a political signal to the countries that have enforced structural adjustment programmes that we are open and willing to be part of that kind of [programme]. Its a confidence building move for the Credit Rating Agencies that South Africa has returned to the net now – [it’s a signal to] the World Bank and International Monetary Fund. It is certainly not a purposive economic strategy. I think it …a lot of people are going to be dissapointed if they think that coming out of this kind of trip you are going to get a major economic transformation in the country.

Tashreeq:

Oupa Lehulere, thank you so much for your time. Oupa is based at Khanya College, a social justice and movement building institution. [He is] talking to us about the envoys that have been announced by President Ramaphosa, also [about] the ambitious target of R1 trillion that has been set and where these envoys and particularly the President is looking to generate this type of investment. It seems to be London as opposed to Asia, and as Oupa rightfully says how Africa should have been the first choice.